Picture this scenario:

You’ve been hit with a great idea for a new company and now you’re looking for a way to take it forward with tangible action. Where do you start? How long will it all take? What do you need to be mindful of?

The world of raising capital is fraught with complications and challenges but can be the most rewarding process if successfully completed. Shieldpay is here to assist and to provide answers and tangible solutions to some of the most pertinent challenges that are likely to arise.

Getting your ducks in order

First things first: It is imperative to be armed with collateral to showcase your idea, its trajectory and its monetisation potential: Preparation is key. Without this collateral, it will be near impossible to secure funding, without which, your fledgling idea, no matter how innovative and wonderful it might be, will not survive.

A few business founders can rely on reputation and a story to secure initial investment funds, but most will need to show something more tangible, namely:

- A tangible product

- Product market fit

- Clear initial traction

- A carefully considered business plan

- Correct company incorporation documents

Setting your funding roadmap

Businesses without a plan can be easily derailed, it’s therefore very important to carefully consider your reasons for raising funds.

1. Know your numbers

The days of picking a number out of the air and hoping for the best are well and truly behind us. Investors will be asking you – and expecting a strong level of detail – how much you and looking to raise and why, i.e. exactly where and how you will be spending any monies raised.

The best way to deal with this is through a considered Use of Funds document that will detail this all out. Investors will understand that there is (potentially significant!) margin for error here but the key is to show that you have dedicated thought and diligence to this process because it is imperative to know your numbers and have a firm grasp of your burn rate. As a founder, you will also need to fully understand your numbers – prospective investors may call you unexpectedly for a quick Q&A and it won’t do you any favours if you need to defer to another member of your team to answer questions that an investor might consider quite fundamental.

2. People buy people

As mentioned, investors expect some slippage from the original forecasts and Use of Funds documents initially provided – this is part and parcel of the start-up world! You’re likely to be doing something for the first time, so everyone accepts there is a learning curve involved. The worst thing you can do here is to try and hide information.

Your investors have seen it all before so they often aren’t easily alarmed – the only thing that can shock and disappoint them is a lack of transparency. Importantly, investors have experience. Often, they might be able to offer perspective and advice that could be valuable if they were apprised of an issue in real time – so do your best to resist the temptation to solely communicate with them during the good times.

Your investor has very likely invested in you as much as in your idea – so do them the courtesy of trusting them the same way they have trusted you.

3. Be forward thinking

All being well, there will be a next funding round. Try and plan KPIs, deliverables and milestones in a way that can be reviewed and adapted for the future. Bear in mind the power of the story you can generate by laying down the foundations and building on them systematically.

There will be slippage, there will be change, there will be innovation. Perhaps the profile of your team will change, perhaps the jurisdictions in which you operate will grow, or indeed contract. There is no right or wrong answer so long as you show a considered decision-making process that is contributing towards positive change, and growth.

Finding the right investor

Once armed with your complete set of collateral, you can begin approaching investors. However, first, you’ll need to consider what your investment goals are; Are you looking for a foot up or an actual helping hand to guide you on your journey? For example, are you looking to raise debt or equity?

When taking on investment, you’ll be best served partnering with investors who share and believe in your vision, understand the challenges of the landscape you’re operating in, and who have the right experience and acumen to help you pursue the goals and targets outlined in your business plan.

Be mindful of the assets and resources that different investor profiles can offer you and do your best to collate a group of investors who can provide different pieces of the whole puzzle.

Angels vs VCs

Angel investors are usually high net worth individuals (HNWI) who have strong experience and networks and who invest their own money on their own behalves, typically at the earliest stages of a new company’s lifetime. Angels can also be friends and family investing in you and your idea, or even a syndicate of HNWIs who band together to co-invest in qualified opportunities. The investment commitment can be of various shapes and sizes, but typically is rewarded with a strong, but proportionate, shareholding in the business to reflect the risk they take in investing their personal funds in a fledgling company. Due to the profile of Angel investors, this source of funding is usually the most accessible form of funding.

Winning venture capital (VC) funding, however, is an altogether different beast. VC firms consist of seasoned, professional investors who are investing funds on behalf of public and private institutions, funds and foundations. The decision-making process is therefore much more involved given the wider ranging responsibilities and considerations. Due diligence will be more substantial, and more people will be involved in deciding whether to make the investment. Venture capitalists typically expect a high return for what they often consider to be high risk investments. Unlike Angel investors, VCs will invest in the larger, later round sizes due to their general capacity to write very large cheques which reflect the time and effort invested in their DD process. Whilst Angel investors may invest in a founder or an idea that shows promise, venture capitalists tend to invest most heavily in industries and trends within which they anticipate growth.

Investor Due Diligence

Investor due diligence extends deeper and further than just evaluating the fundamentals of your idea and your business plan. Investors will conduct detailed analysis on:

- you the founder

- you the company; and

- you the founding team.

After all, you are entering a marriage of sorts. Do you have the required expertise or experience to make this a success? Are you going to stay the course even when things get tough? Are you 100% dedicated to the business or are you going to have multiple projects going on at the same time? Will you be financially secure enough to be able to make the right decisions for the business? It all gets very personal.

With your initial investors, you shouldn’t shy away from going into a similar level of detail. Are they people or institutions that will understand and support you as a founder or as a team when things get tough? Are they financially secure enough to take that risk investing funds into your business, accepting that there is statistically a high risk that they will lose that investment? Will they trust you and leave you to run your business or insist on constant oversight and micromanagement? Will they be able to invest more in the next round?

Most of this can’t be asked directly, but during your courtship with an investor you can start to draw out some of these things. Asking the right questions of the investor shows your maturity as a founder and continues to help build your credibility.

Challenges of KYC/AML

During a Seed or Angel investment round, the profile of investors is likely to be most diverse – ranging from friends and family, to Angel Investors, specialist VCs and beyond.

It is imperative for a business to have credibility and a strong reputation throughout each stage of its growth, however the foundations for this are laid in a company’s earliest days. It is crucial that the need to secure funding doesn’t overshadow and circumvent the integrity of funds that you are absorbing. Conducting rigorous Know Your Client and Anti-Money Laundering checks can be tedious and arduous, but lack of diligence here could be very damaging.

What kind of KYC / AML needs to occur?

- Investor identity must be vetted

- Source of funds must be provided

- Source of wealth should be explored

- Investors must be reviewed against Sanctions lists

- Adverse media checks must be conducted

There are many pitfalls for founders and start-ups but taking on investment funds that are fraudulent or from illegal sources can be avoided and must be a key consideration in your fundraising process.

Shieldpay conducts robust KYC and AML checks on all parties so you can transact with peace of mind, safe in the knowledge that investment monies you’re receiving are not associated with any red flags.

Closing your funding round

How to turn soft commitments into the real stuff – show me the money

Early stage investors are often lovely people who find it difficult to say no, even when they really might want to. This could be because they’re conscious of time spent with you in discussions or because they’re interested in the opportunity but uncomfortable about moving forward without confirmation that other investors will participate in the deal.

After all, if you’re an early stage company with no track record and industry credibility yet, investors could plausibly be concerned that the company takes the money and disappears!

An easy way to provide comfort to investors is to employ the use of an escrow agent to hold investment funds in escrow until the full target raise amount has been achieved.

The benefit is clear and equal for both parties: the company gains firm commitment from the investor and gets them to part with their funds, whilst also offering comfort to the investor that their money will not go anywhere until the agreed terms of the deal, e.g. achieving a certain fundraise level, have been achieved.

Contracting tools like Juro and Seed Legals can be used to draft contracts to reflect these terms and bypass the high time and money costs associated with dealing with law firms.

How to ensure investment funds land on closing day

Despite best intentions to be organised, unforeseen circumstances can sometimes derail a plan of action. Any number of issues could arise on the all-important closing day so it’s important to take measures to mitigate as many of these risks as possible.

Some of these risks include but aren’t limited to:

- Banking restrictions, including capped daily transfer amounts

- An urgent situation arises resulting in diversion of capital earmarked for investment into your company

- Lack of communication between investment partners meaning they are unable to invest in your company at all leaving you with no time to plug this funding gap (N.B. we have a fantastic, real-life anecdotal story associated with this one, get in touch if you want to laugh your way through a head-in-hands moment!)

In each of these scenarios, the ability to see the money in an accessible pool ahead of closing day crunch time. For example, the use of escrow would make all the difference to the success of your funding round, and possibly the success of your company overall.

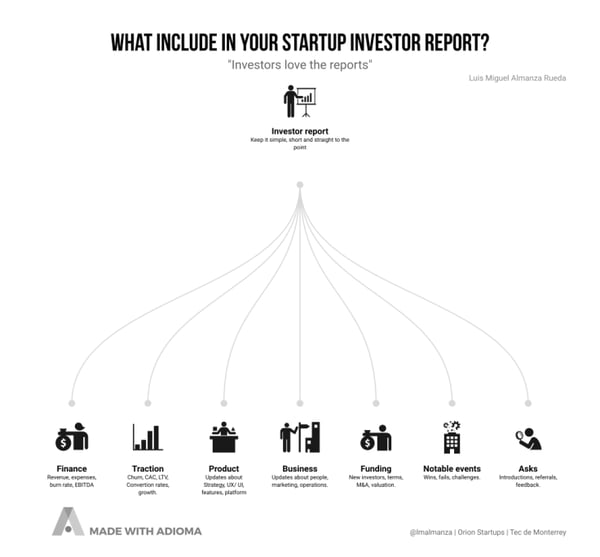

Reporting to investors

The larger the company, the more importance and focus is placed on investor reporting – larger companies dedicate whole functions to Investor Relations. However, even as a new or smaller company,communicating with your investors in a meaningful way is still important and can be very impacting on not only your relationship with the investor, but also their willingness to continue to support you moving forward.

It is important to strike the right balance between reporting back to investors too frequently – thus taking too much time and focus away from actually doing the work to grow your business – and not reporting back enough and thus risk making your investors uneasy.

The other thing to bear in mind, is that you’re reporting the right information. “Right” doesn’t mean cherry picking sporadic things that you think might make you and the business look good – it means understanding the metrics and fundamentals that matter most to your investors and reporting on those whilst being clear, concise and consistent.

For the earliest stage companies, reporting once a quarter is probably the right frequency, increasing to a maximum of a monthly update as your business grows, gains traction and delivers activity that can meaningfully populate a report.

Here is an example of the information you may want to include in your investor report:

The simplest and cheapest way to do this is via a well-structured email, which some choose to template and automate via a sales tool like Hubspot.

The following tools can also help you with other aspects of liaising with your investors:

- Company data reporting: Investory.io is a tool that allows you to report all relevant data to your investors

- Equity Management: Capdesk is an equity management platform that allows you to centrally collate your investor shareholdings as well as your employee share options

What’s the bottom line for fundraising?

When it comes to fundraising, the phrase “time is money” rings truer than ever, because the longer the round takes to close, the higher the deal risk – and this could be the difference between getting investment and having to abandon your potentially life and world changing idea and go back to the drawing board.

The underlying theme for running a successful fundraising process is that preparation is key. While there is no magic 8 ball to foresee deal specific pitfalls, or challenges throughout your life as a start-up, there is a process that can be adopted to avoid the most generic disruptions to a fundraising round that can leave you out of pocket and out of time.

Ready to close?

Discover how Shieldpay’s digital escrow solution for fundraising can help. Enquire today for a quote and to discuss your upcoming funding round.

.png?width=290&name=Untitled%20design%20(1).png)

COMMENTS